Blog

Whistler Real Estate Update – June 2023

CLICK HERE FOR A FULL VERSION OF THE NEWSLETTER

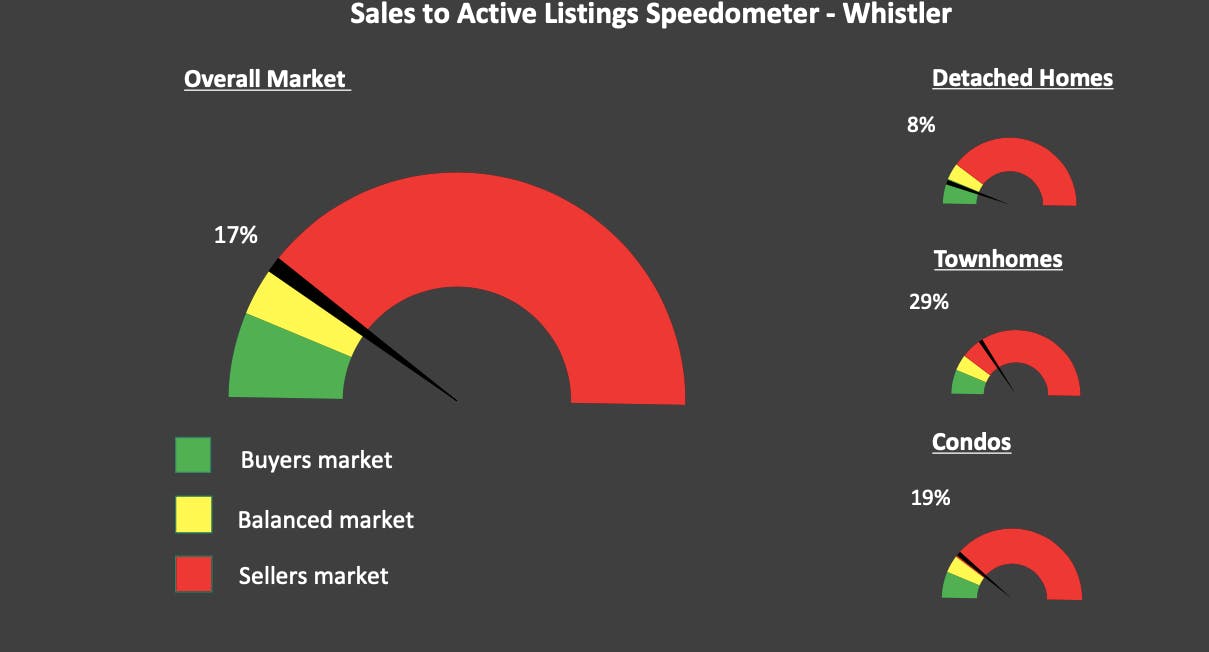

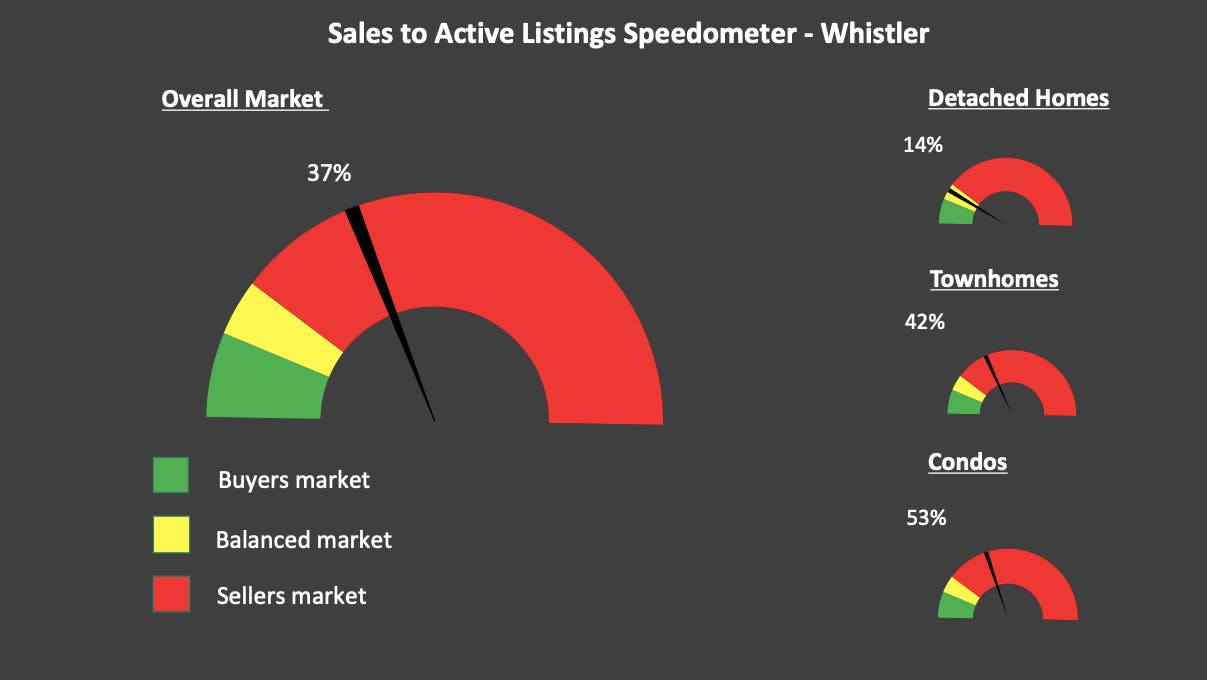

Sales to active ratio:

- May 2023 = 37%

- Detached homes = 14%

- Condos = 53%

- Townhomes = 42%

- Higher than last month = 28%

- Higher than May 2022 = 30%

- Higher than 5yr May average = 25%

- Higher than 10yr May average = 24%

- **Buyer’s market = <12% / Balanced market = 12%-20% / Seller’s market = >20%**

Sales:

- May 2023 = 61

- Higher than as last month = 50

- Higher than May 2022 = 51

- Higher than 5 yr avg = 47

- 30% Higher than 5 yr avg

- Higher than 10 yr avg = 54

- 13% Higher than 10 yr avg

Inventory:

- May 2023 = 165

- Lower than last month =177

- Lower than May 2022 = 168

- Lower than the 5 yr avg = 220

- Lower than the 10 yr avg = 275

In a nutshell

Sales in May were quite good (above average for Mays in the last 10yrs). Inventory still historically low for this time of year, giving a relatively high sales to active ratio (what percent of the average inventory level for that month sold), putting slight upward pressure on prices.

Squamish Real Estate Update – June 2023

CLICK HERE FOR A FUL VERSION OF THE NEWSLETTER

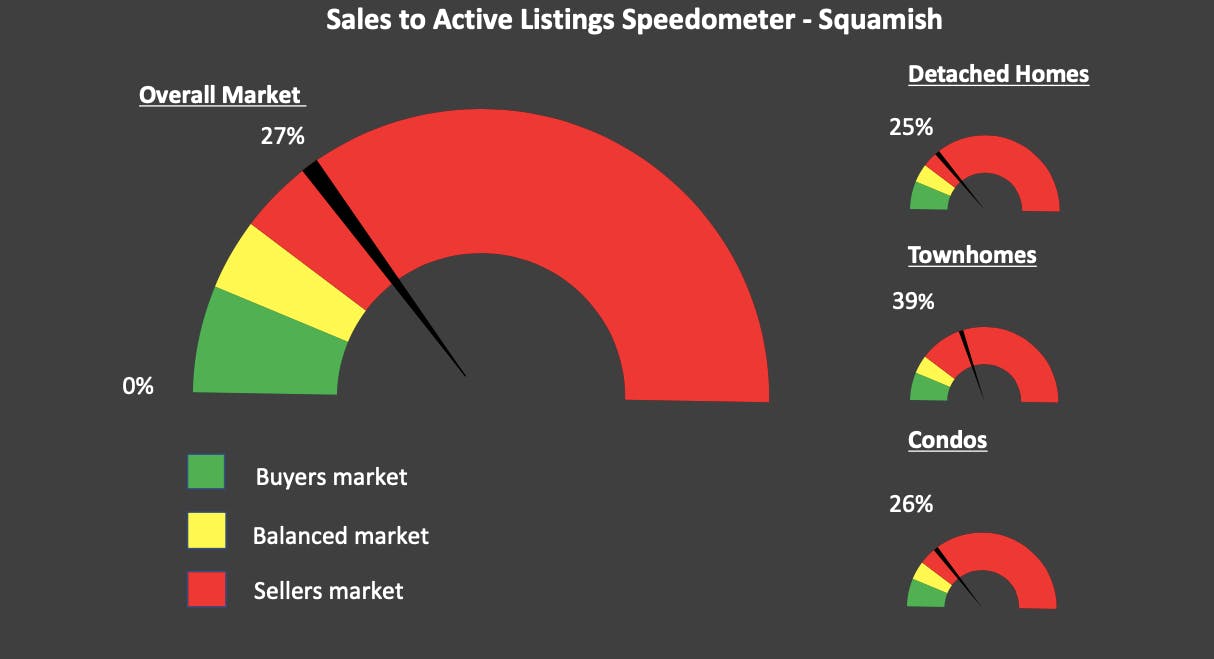

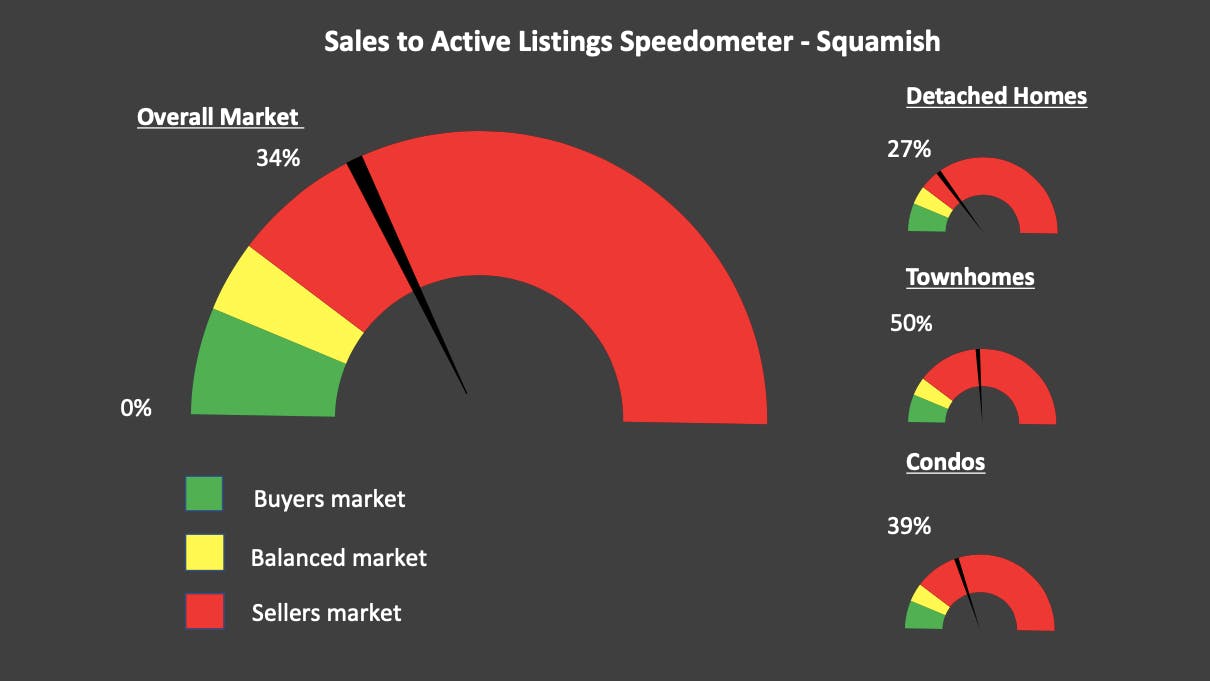

Sales to active ratio:

- May 2023 = 34%

- Detached homes = 27%

- Condos = 39%

- Townhomes = 50%

- Higher than last month = 26%

- Higher than May 2022 = 27%

- Higher than 5yr May average = 28%

- Higher than 10yr May average = 30%

- **Buyer’s market = <12% / Balanced market = 12%-20% / Seller’s market = >20%**

Sales:

- May 2023 = 54

- Higher than last month = 40

- Higher than May 2022 = 49

- Same as May 5 yr avg = 54

- Lower than the 10 yr avg = 63

- 14% lower than 10 yr avg

Inventory:

- May 2023 = 158

- Higher than last month =155

- Lower than May 2022 = 181

- Lower than the 5 yr avg = 208

- Lower than the 10 yr avg = 233

In a nutshell

Sales in May were pretty good (around average for Mays in the last 5yrs). Inventory still historically low for this time of year, giving a relatively high sales to active ratio (what percent of the average inventory level for that month sold), putting slight upward pressure on prices.

Whistler Real Estate Update – May 2023

CLICK HERE FOR A FULL VERSION OF THE NEWSLETTER

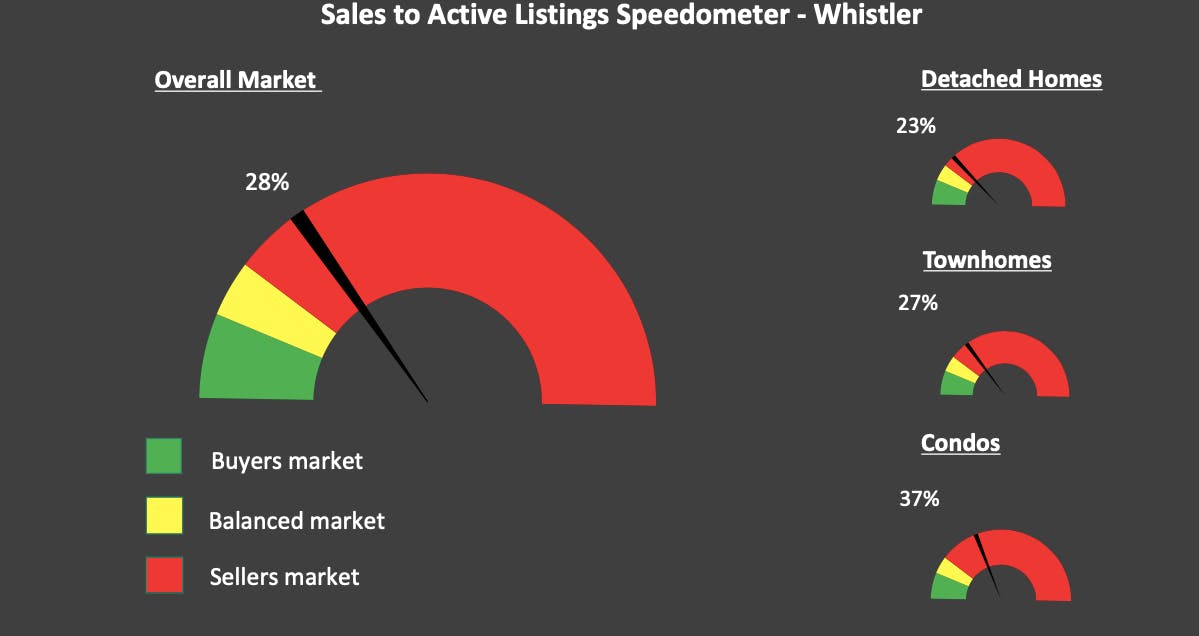

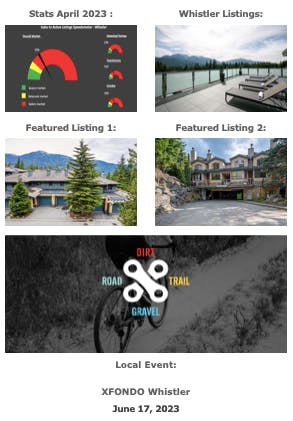

Sales to active ratio:

- April 2023 = 29%

- Detached homes = 10%

- Condos = 39%

- Townhomes = 35%

- Higher than last month = 21%

- Lower than April 2022 = 45%

- Higher than 5yr April average = 26%

- Higher than 10yr April average = 25%

- **Buyer’s market = <12% / Balanced market = 12%-20% / Seller’s market = >20%**

Sales:

- April 2023 = 50

- Higher than as last month = 42

- Lower than April 2022 = 59

- Higher than 5 yr avg = 46

- 9% Higher than 5 yr avg

- Lower than the 10 yr avg = 54

- 7% lower than 10 yr avg

Inventory:

- April 2023 = 171

- Lower than last month =198

- Higher than April 2022 = 132

- Lower than the 5 yr avg = 212

- Lower than the 10 yr avg = 272

Squamish Real Estate Update – May 2023

CLICK HERE FOR A FULL VERSION OF THE NEWSLETTER

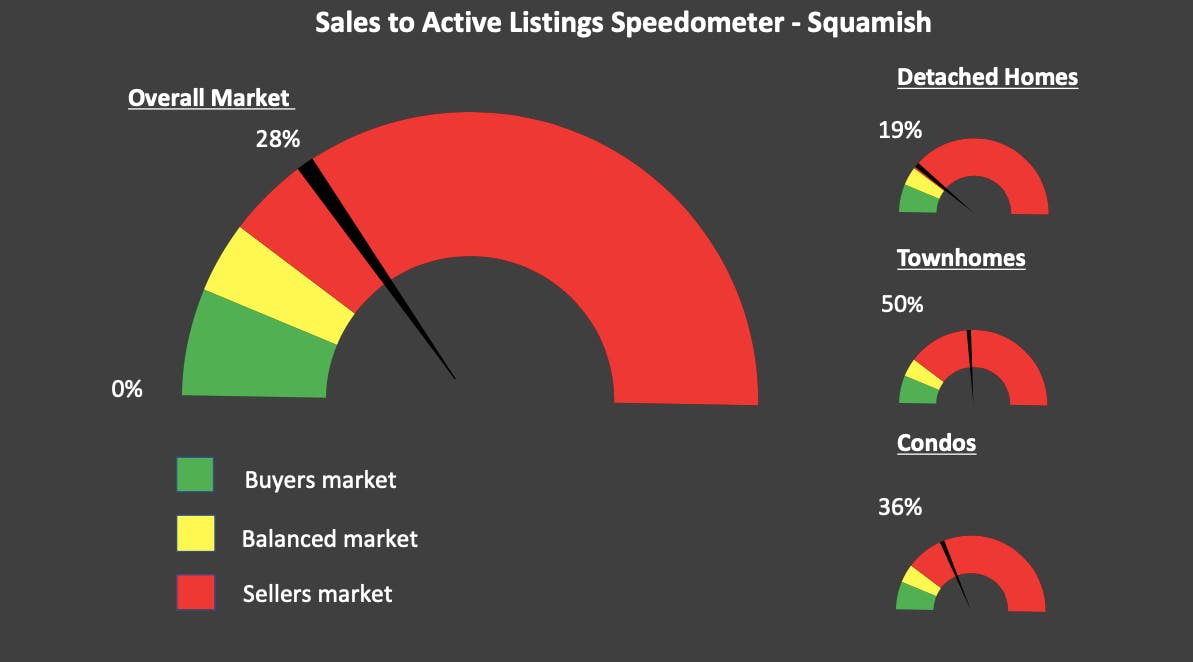

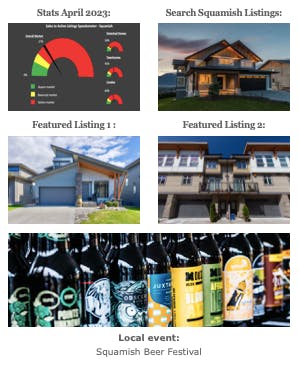

Sales to active ratio:

- April 2023 = 27%

- Detached homes = 16%

- Condos = 44%

- Townhomes = 45%

- Lower than last month = 33%

- Lower than April 2022 = 38%

- Lower than 5yr April average = 29%

- Lower than 10yr April average = 30%

- **Buyer’s market = <12% / Balanced market = 12%-20% / Seller’s market = >20%**

Sales:

- April 2023 = 40

- Lower than last month = 48

- Lower than April 2022 = 52

- Lower than 5 yr avg = 50

- 20% lower than 5 yr avg

- Lower than the 10 yr avg = 58

- 31% lower than 10 yr avg

Inventory:

- April 2023 = 151

- Higher than last month =147

- Higher than April 2022 = 137

- Lower than the 5 yr avg = 216

- Lower than the 10 yr avg = 183

In a nutshell

Meh. Hahaha, that’s the word I’m choosing for how the real estate market is moving along. April sales were just ok, on the lower end of the sales for the last decade of Aprils. Inventory is still relatively low, still lower than 5 + 10 year April averages. I thought the later part spring would have been stronger because of the lack of interest rate hikes, but I was wrong, The market is especially slow in the detached $1.5M-$2M range. I don’t anticipate things picking up much over summer, but I was wrong before so maybe I’ll be wrong again! Bring on summer, let’s see what happens.