CLICK HERE FOR A FULL VERSION OF THE NEWSLETTER

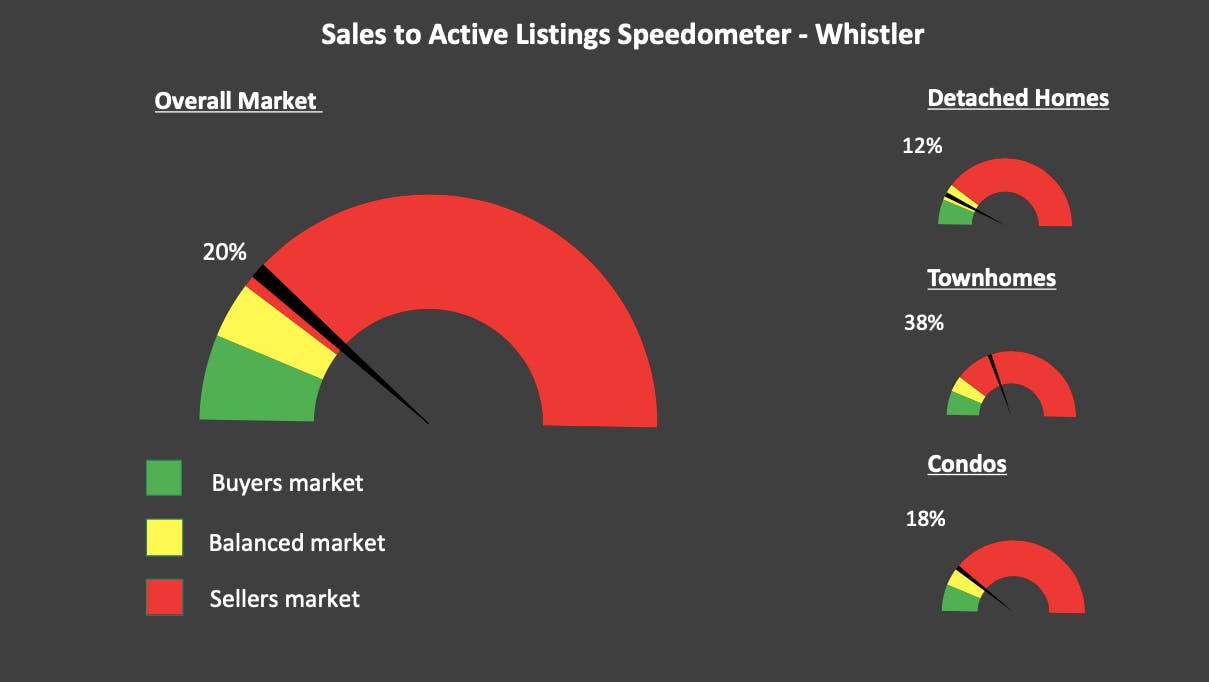

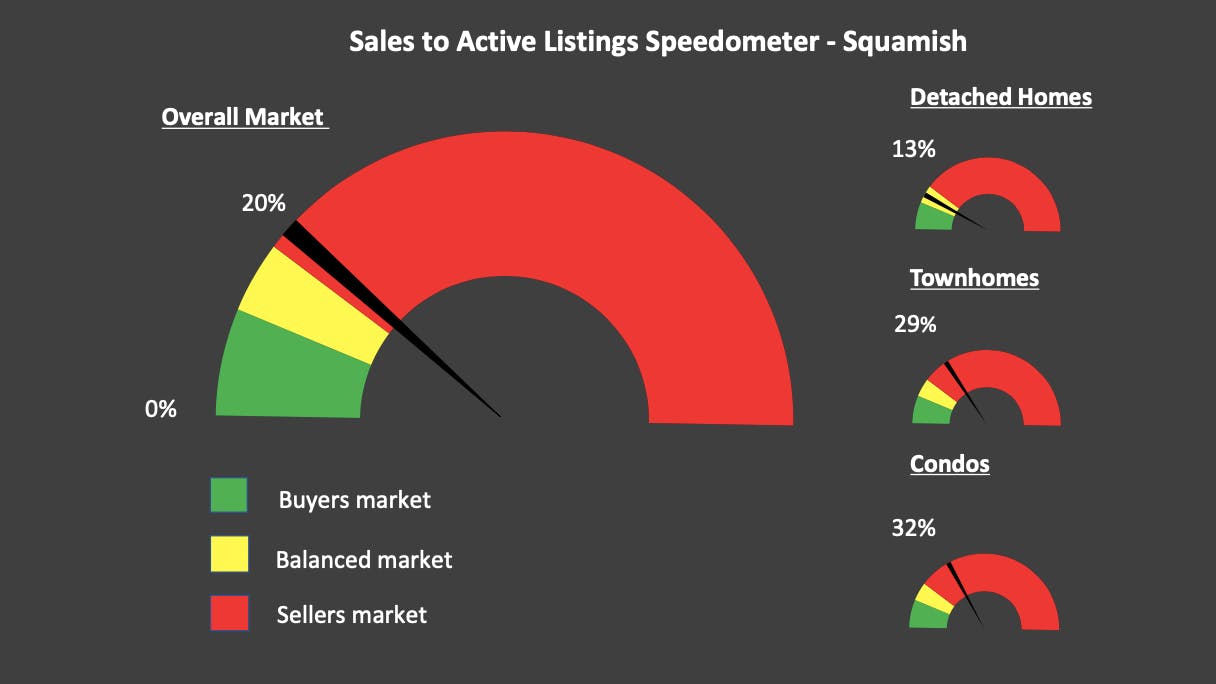

Sales to active ratio:

- February 2023 = 20%

- Detached homes = 12%

- Condos = 18%

- Townhomes = 38%

- Higher than last month = 13%

- Lower than February 2022 = 74%

- Lower than 5yr February average = 32%

- Lower than 10yr February average = 27%

- **Buyer’s market = <12% / Balanced market = 12%-20% / Seller’s market = >20%**

Sales:

- February 2023 = 38

- Higher than as last month = 23

- Higher than February 2022 = 35

- Lower than 5 yr avg = 53

- 28% lower than 5 yr avg

- Lower than the 10 yr avg = 58

- 34% lower than 10 yr avg

Inventory:

- February 2023 = 186

- Higher than last month = 180

- Higher than February 2022 = 105

- Lower than the 5 yr avg = 207

- Lower than the 10 yr avg = 276

In a nutshell

February was pretty slow overall….BUT it picked up in the last week, and it’s still busy right now! With the recent 0% rate hike I anticipate even more life being injected into this already busy spring market.