Blog

Whistler Real Estate Update – April 2023

CLICK HERE FOR A FULL VERSION OF THE NEWSLETTER

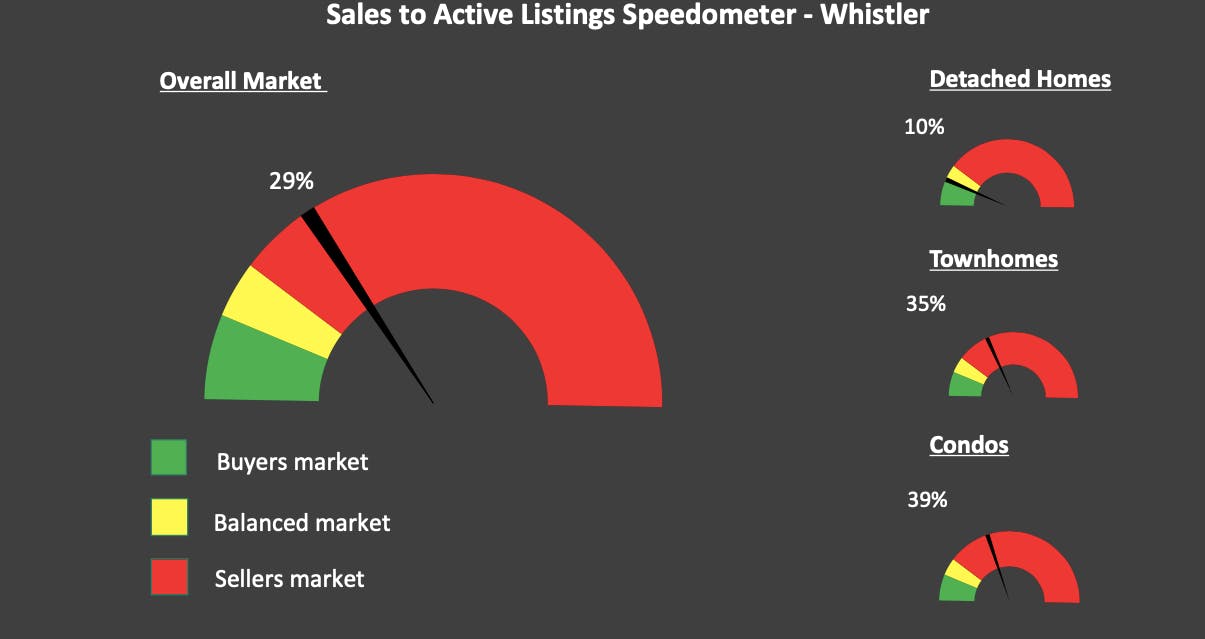

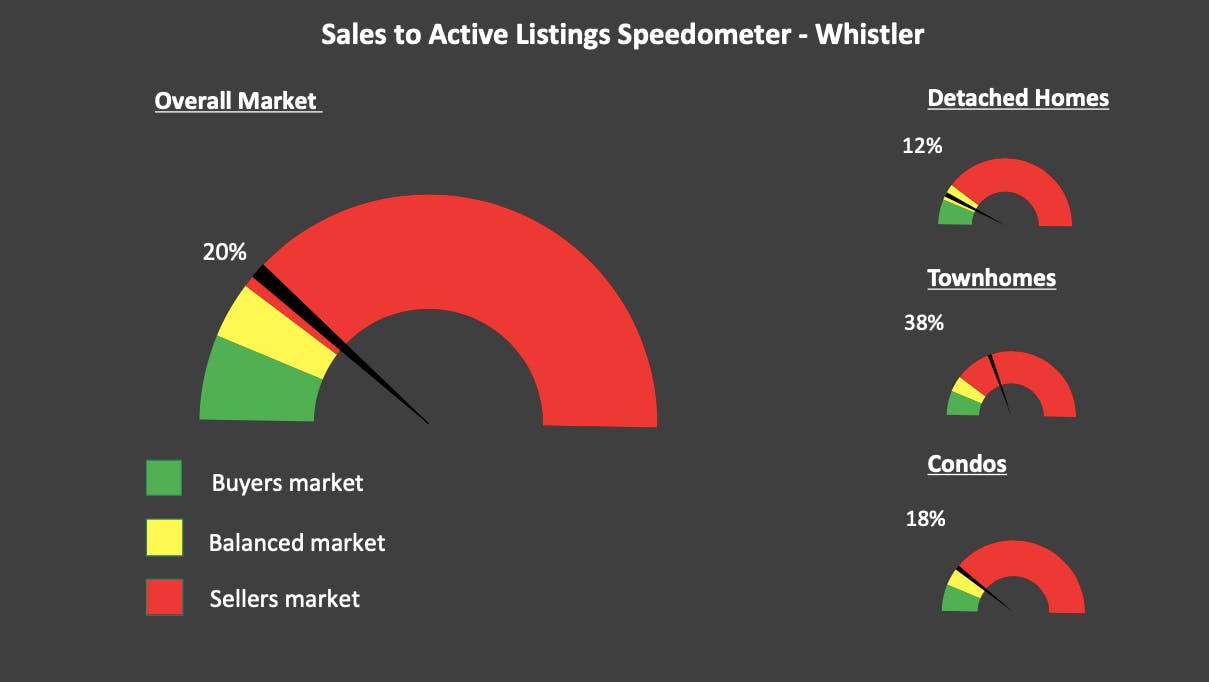

Sales to active ratio:

- March 2023 = 21%

- Detached homes = 17%

- Condos = 24%

- Townhomes = 26%

- Higher than last month = 20%

- Lower than March 2022 = 60%

- Lower than 5yr March average = 33%

- Lower than 10yr March average = 28%

- **Buyer’s market = <12% / Balanced market = 12%-20% / Seller’s market = >20%**

Sales:

- March 2023 = 42

- Higher than as last month = 38

- Lower than March 2022 = 72

- Lower than 5 yr avg = 60

- 30% lower than 5 yr avg

- Lower than the 10 yr avg = 62

- 32% lower than 10 yr avg

Inventory:

- March 2023 = 196

- Higher than last month = 188

- Higher than March 2022 = 119

- Lower than the 5 yr avg = 215

- Lower than the 10 yr avg = 280

In a nutshell

The market is quite busy! No longer am I saying “this was the lowest____(fill in the month) in the last 10 years”. March wasn’t setting any records with sales, but it wasn’t the lowest March in the last decade. Inventory is still extremely low. The last few pause announcements in the overnight lending rate has given buyers some confidence in buying again, I expect to see a strong spring market continue into early summer….then we will have to wait and see!

Squamish Real Estate Update – April 2023

CLICK HERE FOR A FULL VERSION OF THE NEWSLETTER

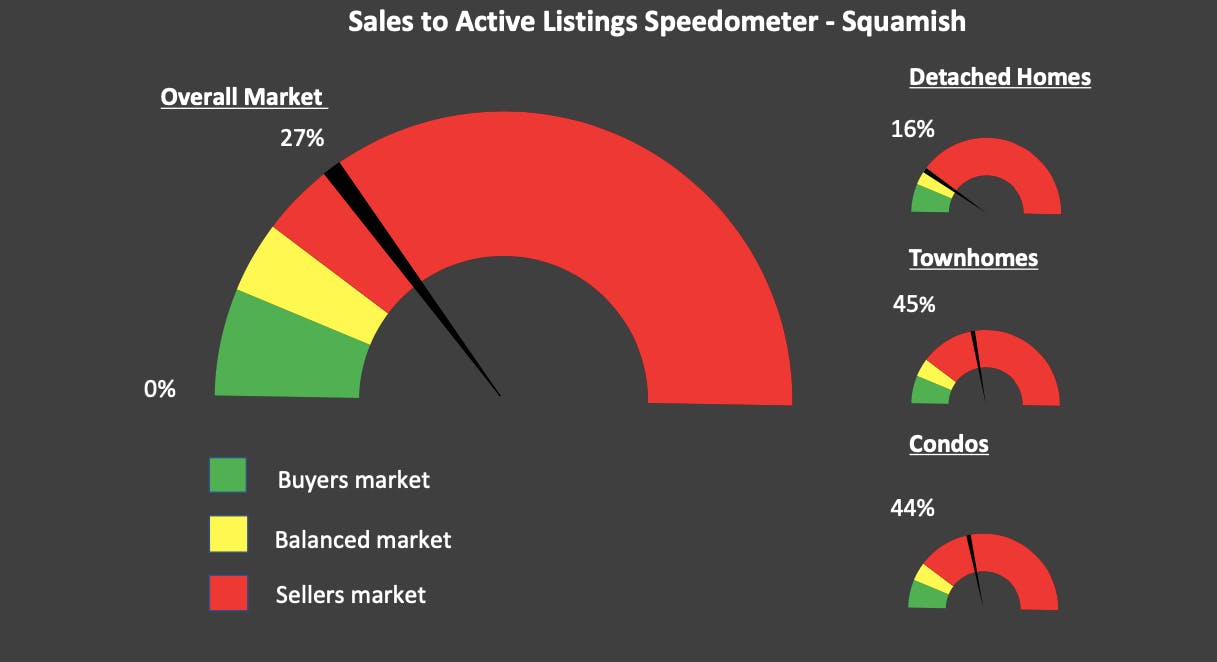

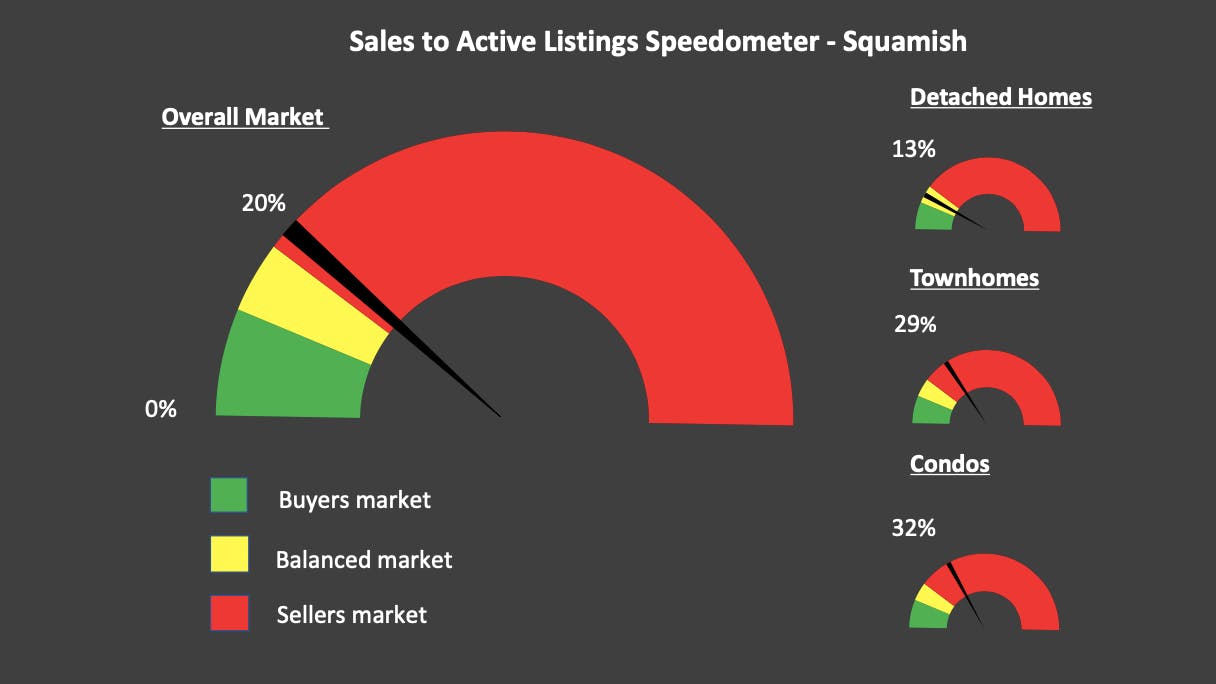

Sales to active ratio:

- March 2023 = 34%

- Detached homes = 20%

- Condos = 44%

- Townhomes = 63%

- Higher than last month = 19%

- Lower than March 2022 = 70%

- Lower than 5yr March average = 40%

- Lower than 10yr March average = 35%

- **Buyer’s market = <12% / Balanced market = 12%-20% / Seller’s market = >20%**

Sales:

- March 2023 = 48

- Higher than last month = 28

- Lower than March 2022 = 71

- Lower than 5 yr avg = 59

- 18% lower than 5 yr avg

- Lower than the 10 yr avg = 59

- 18% lower than 10 yr avg

Inventory:

- March 2023 = 142

- Lower than last month =147

- Higher than March 2022 = 102

- Lower than the 5 yr avg = 162

- Lower than the 10 yr avg = 205

In a nutshell

The market is quite busy! No longer am I saying “this was the lowest____(fill in the month) in the last 10 years”. March wasn’t setting any records with sales, but it wasn’t the lowest March in the last decade. Inventory is still extremely low. The last few pause announcements in the overnight lending rate has given buyers some confidence in buying again, I expect to see a strong spring market continue into early summer….then we will have to wait and see!

Whistler Real Estate Update – March 2023

CLICK HERE FOR A FULL VERSION OF THE NEWSLETTER

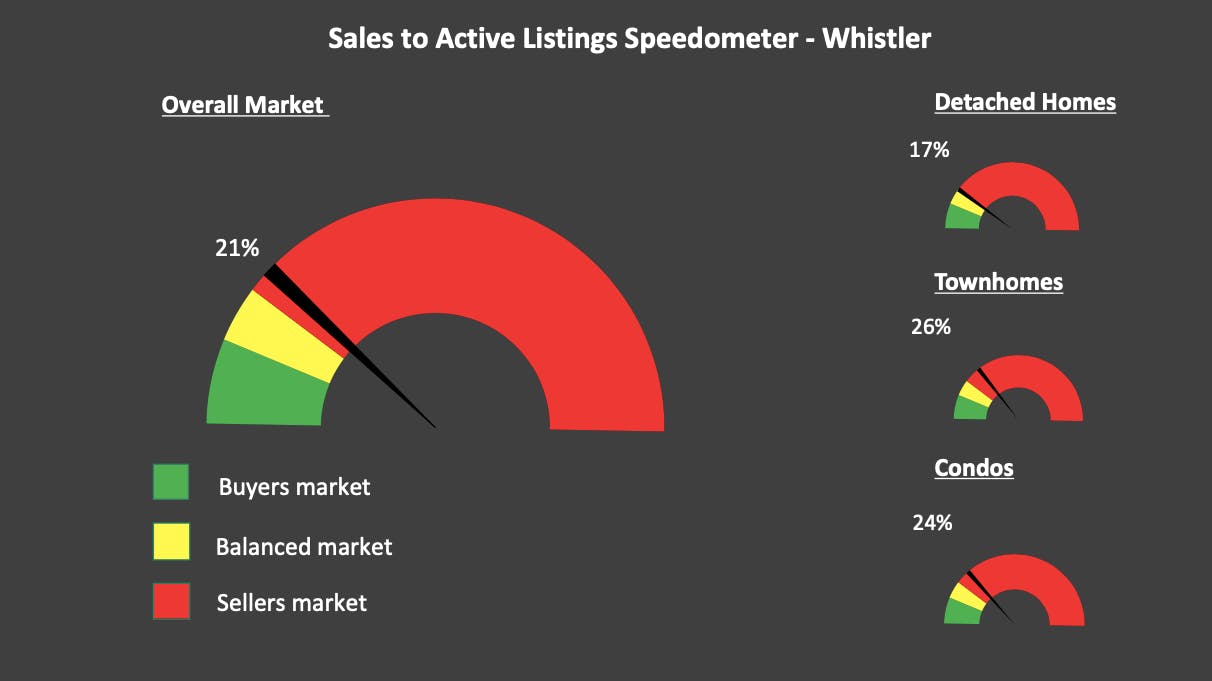

Sales to active ratio:

- February 2023 = 20%

- Detached homes = 12%

- Condos = 18%

- Townhomes = 38%

- Higher than last month = 13%

- Lower than February 2022 = 74%

- Lower than 5yr February average = 32%

- Lower than 10yr February average = 27%

- **Buyer’s market = <12% / Balanced market = 12%-20% / Seller’s market = >20%**

Sales:

- February 2023 = 38

- Higher than as last month = 23

- Higher than February 2022 = 35

- Lower than 5 yr avg = 53

- 28% lower than 5 yr avg

- Lower than the 10 yr avg = 58

- 34% lower than 10 yr avg

Inventory:

- February 2023 = 186

- Higher than last month = 180

- Higher than February 2022 = 105

- Lower than the 5 yr avg = 207

- Lower than the 10 yr avg = 276

In a nutshell

February was pretty slow overall….BUT it picked up in the last week, and it’s still busy right now! With the recent 0% rate hike I anticipate even more life being injected into this already busy spring market.

Squamish Real Estate Update – March 2023

CLICK HERE FOR A FULL VERSION OF THE NEWSLETTER

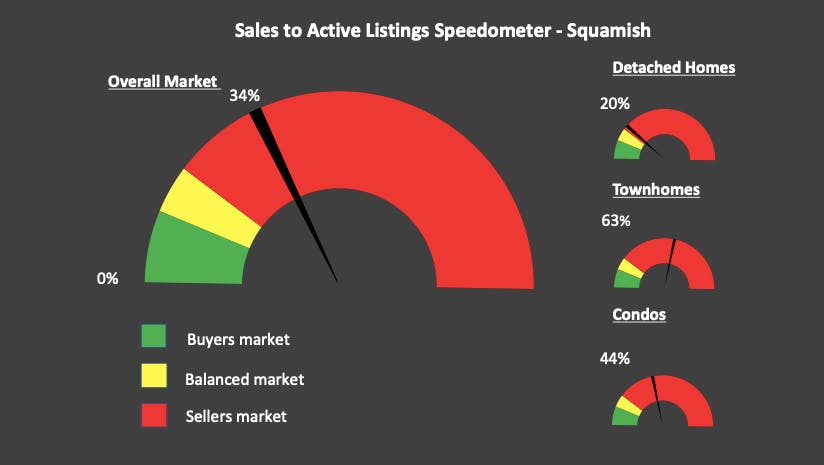

Sales to active ratio:

- February 2023 = 20%

- Detached homes = 13%

- Condos = 32%

- Townhomes = 29%

- Higher than last month = 14%

- Lower than February 2022 = 94%

- Lower than 5yr February average = 42%

- Lower than 10yr February average = 33%

- **Buyer’s market = <12% / Balanced market = 12%-20% / Seller’s market = >20%**

Sales:

- February 2023 = 28

- Higher than last month = 17

- Lower than February 2022 = 80

- Lower than 5 yr avg = 55

- 49% lower than 5 yr avg

- Lower than the 10 yr avg = 49

- 43% lower than 10 yr avg

Inventory:

- February 2023 = 143

- Higher than last month =123

- Higher than February 2022 = 85

- Lower than the 5 yr avg = 152

- Lower than the 10 yr avg = 193

In a nutshell

February was pretty slow overall….BUT it picked up in the last week, and it’s still busy right now! With the recent 0% rate hike I anticipate even more life being injected into this already busy spring market.